of graduate employers say relevant experience is essential to getting a job with them

Why choose this degree course?

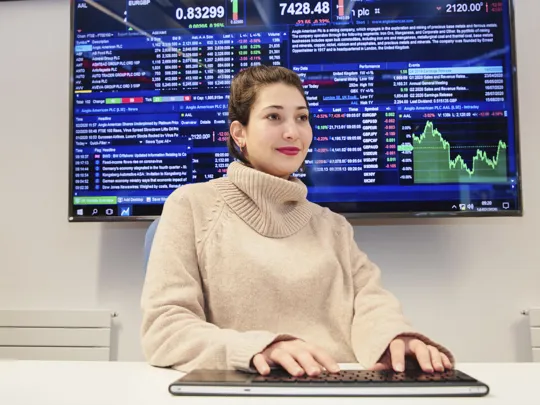

- PRACTICAL APPLICATION – Work on live consultancy cases with local and international clients in our state-of-the-art Financial Trading Suite

- SPECIALISE YOUR STUDIES – Choose a topic within the industry that interests you to study in depth for your final research project

- INDUSTRY APPROVED – Our course is developed and delivered in partnership with key industry players and professional bodies

- AWARD-WINNING UNIVERSITY – Study at the highest-ranking university in the region according to student choice (Whatuni Student Choice Awards 2023)

Our facilities

Students on our accounting and finance degree courses at University College Birmingham enjoy a wealth of practical learning opportunities in our cutting-edge Financial Trading Suite on campus, while we also provide a range of support services for student entrepreneurs through our Enterprise Hub.

Course breakdown

- Modules

Core Modules

Financial Reporting

This module aims to develop accounting standards and theoretical framework knowledge in the preparation of financial statements. The module addresses the key issues in international financial reporting and financial analysis. It covers the fundamentals required by managers and analysts to understand, interpret and use financial information. The module will help you understand the financial reporting challenges of multinational companies. It will aim to give you the tools and skills to compare accounting regulatory frameworks around the world as well as to prepare and interpret consolidated financial statements.

Leadership and Enterprise Strategy

Leadership and Enterprise Strategy aims to provide an understanding of strategic analysis, strategic decision-making and strategic processes within organisations. The module content comprises two complementary components. The first involves the understanding and learning of the main strategic management concepts and theories. The second implies its application in organisations.

Performance Management

This Performance Management module is about making decisions which ensure the most effective and efficient use of organisational resources. The module aim is to develop knowledge and skills required by performance managers. This provides students with a grasp of techniques used by performance managers in planning, control, decision-making and overall performance evaluation of organisational activities. It focuses on information needs, technologies and systems necessary for efficient and effective performance management of organisations. This is followed by an examination of decision making processes with particular emphasis on management of scarce resources and how this relates to performance, uncertainty and risk management. A key aim of performance management is to measure costs and revenues relating to specific operations, divisions and products. Information gathered in this way is used to plan and control activities in order to ensure that key organisational objectives are achieved.

Research Project

You will have the opportunity to engage in an independent research project of your choice. You will have support with preparing your proposal and understanding the competent characteristics of good research. An appointed tutor will help guide you through this important and rewarding process.

Choose 1 optional module

Corporate Risk Management

Corporate Risk Management is a comprehensive, systematic approach for helping an organisation to identify, measure, prioritise and respond to risks, which is critical when developing a company's strategy. The module gives you an opportunity to understand the implementation and application of Corporate Risk Management and develops skills which are applicable to a diverse range of organisations and scenarios.

Portfolio Management

The module introduces the latest methodologies used by professional portfolio managers. The module addresses both the theory and practice of portfolio management and aims to build on the techniques for portfolio selection. The theoretical part will examine the issues involved in constructing an investment portfolio, evaluating its performance, and adjusting its composition through time to ensure the performance remains optimal. It will also consider the use of derivatives in managing risk. The module will provide you with hands-on experience of constructing and managing an equity portfolio in our newly built Financial Trading Suite.

The modules listed above for this course are regularly reviewed to ensure they are up to date and informed by industry as well as the latest teaching methods. On occasion, we may need to make unexpected changes to modules – if this occurs, we will contact all offer holders as soon as possible.

Entry requirements

Entry requirements

Academic: A relevant HND or a foundation degree in the areas of accounting, banking and finance, business finance, economics or finance, with 240 credits.

If you are unsure if your previous qualification is suitable, please contact us before completing an application. You can complete our enquiry form here or call us on 0121 604 1040

Key information

Teaching and assessment

Note: Indicative information only – actual timetables and assessment regimes will be issued at your induction.

Teaching

Learning strategies include:

- Lectures (including guest lectures)

- Small group seminars

- Workshops

- One-to-one tutorials

- Group projects

- Virtual Learning Environment (VLE)

- Self-directed study

You will need to commit around 20 hours per week for individual study time.

Assessment

Assessment formats include:

- Examinations

- Coursework (including presentations, essays, reports, multiple choice tests and numerical computations)

Our teaching and assessment is underpinned by our Teaching, Learning and Assessment Strategy 2021-2024.

Kick-Start Scheme

As a new student studying this course full-time, you will receive £300 per year through our Kick-Start Scheme (UK students only, eligibility criteria applies). This scheme will support your studies and future career by contributing to course-related materials, uniform or selected items on campus. You may also qualify for an additional £500 per year.

Find out more about the Kick-Start Scheme here.

Unibuddy Community - meet other students on your course

Starting university is an exciting time, but we understand that it can sometimes feel a little daunting. To support you, you will be invited to join our Unibuddy Community, where you can meet other students who have applied for the same course at University College Birmingham, before you start studying here.

As soon as you have been made an offer, you will be sent an invitation email to complete your registration and join the Unibuddy Community. For more information, check out our Unibuddy Community page.

Accreditations, endorsements and partnerships

University College Birmingham works with a wide range of organisations to ensure you receive the best possible training and qualifications recognised by industry.

Work experience

Work experience is vital for learning how to apply your training in the real world and for building your confidence and skills before you finish your course – and it may even lead to a job when you graduate. Our Hired team can help you find suitable work experience.

We encourage students on our BSc Finance and Accounting top-up course to gain work experience throughout your studies.

Career opportunities

The example roles and salaries below are intended as a guide only.

Finance officer

Average Salary: £29,250

Analytics manager

Average Salary: £47,392

Budget analyst

Average Salary: £43,217

Data analyst

Average Salary: £32,500

Mortgage adviser

Average Salary: £52,500

Want to take your studies to the next level? Completing the BA (Hons) degree will enable you to move onto our postgraduate courses such as Finance and Accounting MSc/PGDip or Enterprise Management MSc/PGDip.

Asif’s Story

An expert in the development of this degree explains how it is designed to set students up for rich careers.

Meet your lecturers