June 2023

Guest Blog | How can I get tax-free university fees for my child?

By Edwards Accountants

Share post:Read time: approx 5 mins

As we head closer to the start of the new academic year, many soon-to-be university students are getting ready to move away from home for the first time and embark on the next step in their educational careers.

University fees make this next step an expensive endeavour for students and their families alike – but what if there was a more tax-efficient method for covering the costs of your child’s university fees?

Luckily for many business owners, gifting your child shares in your company can help you pay for your child’s university fees completely tax free.

Can I benefit from these tax savings?

If you’re a business owner with shares in a company, whether you operate from your kitchen table or have multi-million turnovers, then you may be able to benefit from tax savings when it comes to your child’s university fees.

Unfortunately, due to the requirements for this tax saving, people who are employed by a business rather than being an owner will not be able to benefit.

What tax savings are on offer?

As a business owner, you may decide to take additional dividend income from your company and use this to pay for your children’s university fees – but this isn’t very tax efficient.

If you take your dividends out of the company in this way, you will be liable to pay tax on the gross pay-out, and they will be taxed at 8.75%, 33.75% or 33.95% depending on what income band you sit in. Therefore, if you wanted £9,000 to put towards your son or daughter’s university fees, you would need to take £13,585 from your dividends if you are a higher rate taxpayer.

However, there are ways to save this tax by utilising your child’s £12,570 tax-free personal allowance, and their £2,000 tax-free dividend allowance, to take money from your company to pay for your child’s university fees.

How do these tax savings work?

University students are often supported by their families during their time at university, with most students not having tax-paying jobs.

As a result, potential tax savings are going to waste, as you’re not taking advantage of your child’s tax-free allowances totalling £14,570. Most university courses last for 3 years, meaning that you would be able to extract a total of £43,710 (£14,570 x 3 years) during your child’s course. However, the cost for you to withdraw this amount normally would be almost £66,000 – saving you over £22,000 in tax!

With interest charges on tuition fee loans (currently 7.3% until 2024/25, then CPI plus 3%) and in times of rocketing inflation, student loans are not a good option if the family are able to support their children. Also, interest rates now run from the date the loan is taken out, rather than the completion of the course.

Therefore, gifting 10% of dividends to your child can help you pay for their university fees without any tax implications or being impacted by interest rates.

How do you make giving shares to your children from the family business safe?

Using a trust or another similar vehicle can ensure that your funds and shares cannot be abused and that they are kept safe.

A trust also gives you more control over your child’s finances whilst allowing them to benefit from being a beneficiary.

What do you need to be aware of with these tax savings?

There are tax consequences with this tax saving. However, as long as your child doesn’t have a part-time job, you should be able to pay each year of your child’s university fees completely tax-free.

Giving your child shares in your business is also more commonly accepted by HMRC. Whereas, other methods, such as choosing to give your son or daughter a 'job' at your company to pay for their university fees can be an issue with HMRC.

How can accountants help?

As taxation experts, accountants can help business owners identify and utilise the tax opportunities available to reduce tax outgoings, including utilising your shares to pay your child’s university fees. They can also support your business with a range of other services.

For more information contact:

Tel: 01922 743 100

Email: aldridge@edwardsaccountants.co.uk

Website: https://edwardsaccountants.co.uk/

Latest news stories

Record-breaking £27k raised for life-limited children at charity dinner

Two iconic Brummie chefs led first year students from the Culinary Arts Management degree in a spectacular charity even…

Read more

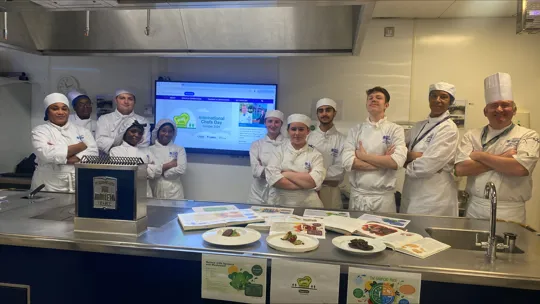

Talented student foodies inspire world for International Chefs Day

Talented students put their skills into action in the University kitchens to mark International Chefs Day in partnership wit…

Read more

Tourism students set to shine as University hosts national convention

University College Birmingham is excited to announce it will host the annual convention of the TMI.

Read more

Digital T-level placement students support racial empowerment

Digital T-level students at University College Birmingham have been supporting racial empowerment through a placement with city-b…

Read more

Sports graduate makes Top 100 in UK marketing influencer awards

A go-getting graduate who now organises VIP hospitality for the likes of Wimbledon has been named one of the top 100 influence…

Read more

Invictus Games inspire at tourism and events conference

The new academic year got off to a flying start as the Business School hosted its third annual Inspire Conference.

Read more